Discover more from Life in the 21st Century

Filthy lucre ain’t nothing new

And we all get cash from chaos

Haven't wrote, or talked for that matter, much about money in the last decade. I've been following money since the late 1970s inflation. A tender age realization the money question was an issue that could take down a president. An issue, so it seemed, you needed to learn a lot about. Yet over the years since, as the money system changed in many ways dramatically, I realized it was an issue you could almost never talk about publicly, only in dark halls and closets, with “cranks” like Greider. In fact, it was my personal experience from the mid-1980s until 2008, when the whole thing started heading down fast in flames, it was basically absent from any public discussion.

Money, that is the power that resides around it, doesn't want to talk about money. They want money to seem perpetually stable, one of the eternal verities. The history of money has shown it be anything but that, an evolving, dynamically moving target since we started using shells and wampum as currency. I remember reading Greider's Fed history those years ago, he taught me money, no matter what the currency, just gets created. A few years later I got to know Greider and told him this insight he provided.

He laughed and replied, “It's like telling people there's no god.”

I still like a good money history, though modern-finance, as all modernity, has no use for history. However, Chris Whalen, who Greider introduced me to fifteen years ago, just suggested a paper from last year, Money and the Public Debt: Treasury Market Liquidity as a Legal Phenomenon, an insightful money history, most amusingly published by Columbia Law School. It’s well worth the read for anyone half-concerned with money in the 21st century.

As I read the paper, I kept thinking why hasn't anyone put this together before now? I knew the pieces, but no one connected them together well, especially avoiding so many facades, the Temple, constructed to obscure the view. Again, finance don’t like no history, no little barking dogs peeling back curtains, everyone just wanta believe a dollar is a dollar.

Reading the paper, I was reminded of a decade or so ago when the MMTers arose. They were overly enthused by the idea money is just created — yes, great, but that's just one element, inarguably an important one, nonetheless one. Centralized money creation, that’s how the present system work.

Instead of just printing currency for federal fiscal obligations, the US Treasury issues debt — treasury bonds — which is a definition of money, an idea, the authors astutely note, understood and promoted by America's first Treasurer, essential bank advocate, recently favorite founder, and Caribbean-son Alexander Hamilton. The modern money system is bank-debt money and Treasury debt, that can be leveraged again and again.

The Fed creates money too, it prints currency. Now there’s an anachronism for ya! It’s interesting how the adoption of paper currency caused decades of monetary turmoil, but we went from paper to digital in a blink of an eye, without so much a whimper.

The Fed money creation process today is Ctrl-Alt-$, releasing their spreadsheet creations into the greater system through the banks, but as this Columbia paper shows, the Fed's money printing and dishing out mandate has broadened appreciably over the century, most especially as dollar/treasuries followed the American military and became the predominate and essential global currency.

The paper uses the term providing “stability” for many of the Fed's actions over the years. But certainly and especially since '08, this paper is excellent documenting you can replace “stability” with “inflating up.” Every financial change since ‘08, and there’s been significant changes, was done to insure equities, bonds, homes... et al., keep going up, and up they’ve gone. Bernie Madoff was no system outlier. The only truly unchanging thing about this past century's money system is the Fed keeps pumping more and more.

It's difficult to argue the present money system provides healthy economic vitality, or much of anything, except mountains of filthy lucre for those directly participating in its creation and manipulation. Most especially, it's impossible to say this money system at this point allows the valuing of economic activity, certainly not in anyway life or even in the most rudimentary measure of value for decisions by all about the hard economy.

This is first really good thing I’ve seen about the last 15 years muck, and as a bonus it’s tied into an excellent history of the creation of the American monetary system. All you can say about the culmination of the last fifteen years is the SEC approved bitcoin trading a few months ago, it’s how the whole thing operates. Just think if you were using bitcoin as a currency, just the last six months you’d be paying 25% more for everything. Hell, give me Bidenonmics.

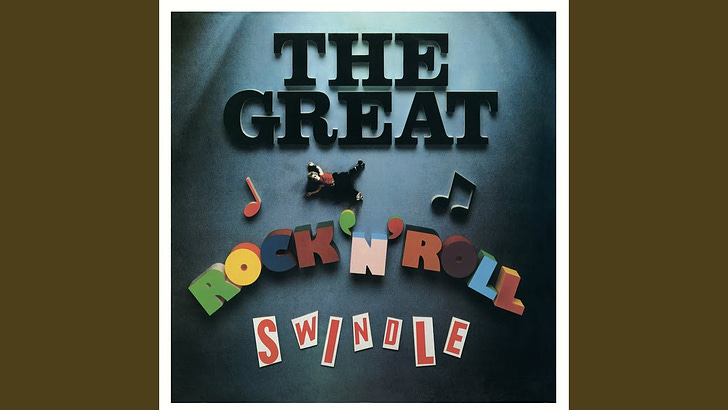

It’s a swindle.

Subscribe to Life in the 21st Century

History, Science, Energy, Technology, Environment, and Civilization