Discover more from Life in the 21st Century

Money Reform & Information

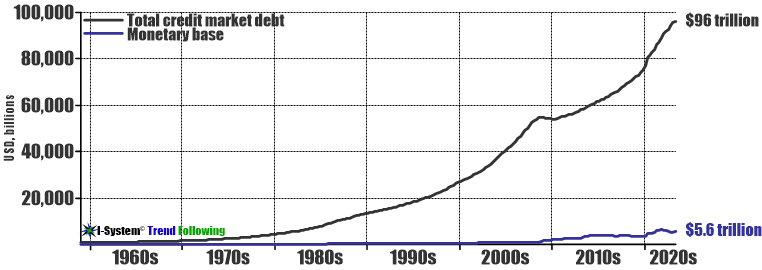

I recently received an email from a friend that included this money chart created by a financial firm called TrendCompass:

Using Fed numbers, this is just a great graphic charting the last decades financialization of the economy. The top black line is “credit,” aka debt, while the bottom line is the “monetary base” or cash money. I don't want to get into the semantics of money, oh lord that's funny, talk to the Fed if you got problems, but what the chart shows is the financial system leveraged 20 times. Over the course of its acceptance, through trial and era, it became a sort of a rule of thumb that 10 to 1 leverage promoted financial stability in the modern bank-debt money system and so, well, here we are.

The numbers don't include derivatives, which according to the Bank of International Settlements in 2022 amounted to $634 trillion globally. That's six times more than the total debt. Most derivatives are just an accounting scam, fraud some might say, on various entities’ books, most cancel each other out. However, the BIS notes, “The gross market value of outstanding OTC derivatives, summing positive and negative values, rose noticeably in the first half of 2022, to $18.3 trillion, led by increases in interest rate derivatives.” That's a lot of cash money someone would need to pony up if the money system started shaking like it did in 2008.

Remember, always a funny term when talking to Americans, the Financial Crisis Inquiry Commission's 2011 report stated unregulated derivatives were “a key turning point in the march toward the financial crisis.” I'm on record way back then, the day report was released, saying it would never be talked about again. But, here you go Byron, once again you can say, “Costello wrong again. How that guy even types a keystroke is simply ridiculousness.”

The explosion in derivatives was the last gift Mr. Bill bequeathed to the monied class right before he left office signing the “Commodity Futures Modernization Act.” That codified such wonderful things as, “No provision of the Commodity Exchange Act shall apply to, and the Commodity Futures Trading Commission shall not regulate, a hybrid instrument (derivative),” and better, “This title shall supersede and preempt the application of any State or local law that prohibits or regulates gaming or the operation of bucket shops” – Oh Bubba! Who knew in his '92 Democratic acceptance speech when Mr. Bill rhapsodized about a “New Covenant,” he was actually talking about a new felonious bank covenant?

Well enough bad nostalgia, as far as the stability of the financial system, place your bets, money is and has always been a work in progress. But such numbers do reveal several things. First, while the modern bank-debt money system was never democratic (see the Populists), it is far more undemocratic than ever, an entrenched money oligarchy with a great interest in sustaining an unsustainable status quo, the only way the debt can be repaid.

Secondly and more importantly, as an information medium in a self-proclaimed market system, money has become increasingly valueless in regards to its information content. Technology historian Marshall McLuhan wrote in Understanding Media,

“Money, had been for many centuries the principal transmitter and exchanger of information… Money is a language for translating the work of the farmer into the work of the barber, doctor, engineer, or plumber. As a vast social metaphor, bridge, or translator, money – like writing – speeds up exchange and tightens the bonds of interdependence in any community.”

The information content of money was and is always critically dependent on the greater information environment of the society as a whole. McLuhan writes,

“Shortly before the advent of paper money, the greatly increased volume of information movement in European newsletters and newspapers created the image and concept of National Credit. Such a corporate image of credit depended, then as now, on the fast and comprehensive information movement that we have taken for granted for two centuries and more.”

Like all information, the information value of money is dependent on its communication, and as McLuhan notes, paper currency, to the consternation of every gold bug, facilitated and necessitated much faster communication,

“Representative money, based on print technology, created new speedy dimensions of credit that were quite inconsistent with the inert mass of bullion and of commodity money. Yet all efforts were bent to make the speedy new money behave like the slow bullion coach.”

Until the creation of the Fed in 1913, money was still largely based on metals, but this changed over the next six decades, money was completely relieved of its gold weights.

The growth of debt since 1980 directly correlates with the growth of the computer industry and electronic money. With computers came an exponential rise in information, information moving at the speed of light, along with the necessity of this information being monetarily valued for utilization. Yet, modern society's predominate or even exclusive valuing of all information monetarily degenerated the value of money, simultaneously distorting and diminishing the value of information.

“Apart from communal participation, money is meaningless.”

Money has always been and always will be a political medium. Information and communication have always been fundamental elements of politics, of all human social organization. Now, information is fundamental in reshaping the greater physical environment surrounding us. Looking from this perspective, we see the political system itself has become ever more flooded with money and thus increasingly dysfunctional. The corporation, one way or other the source of most political money, is itself a creation of money. Incapable of anything except monetary valuation, the ability of the corporation itself to effectively utilize the ever vaster flood of information also falters.

Such a situation cries not just for reforming money, as the crypto-crowd so poorly advocates, but the reform of politics, government and all our associations, including corporations, enabling them to value information without having to exclusively transform it into monetary value. It's very difficult in an era now completely dominated by money for us to understand or even conceive of non-monetary value, especially true when an oligarchy of money demands subservience. Yet, across human history most information was created, communicated, and valued non-monetarily. For example, our dilapidated democracy still has the remnants of the vote, a non-monetary value system, though now completely dominated by money.

While money, one way or other, has always had information content, the monetary value of all information is new. In the last four decades, enormous amounts of debt have been created, in part, as an attempt to value the exponential explosion of information. It is a losing game for the value of both money and information.