Discover more from Life in the 21st Century

The Dismal Science, Inflation, and Information

Here a tower shinning bright once stood gleaming in the night

Where now there's just the rubble in the hole

There the Paddies and the Frogs came to gamble on the dogs

Came to gamble on the dogs not long ago

It's difficult to read anything about the economy these days, especially why things are happening as opposed to what, though in itself what ain't easy to figure either. It's all a bit fantastical for someone who spent many years reading volumes about the economy, economics, and following economic data. Today, nothing works how the economists – left, right, or center — claim. The most recent jarring example is inflation with many ideas about inflation falling by the wayside in the last couple decades.

Despite debt, both public and private, growing at unprecedented rate in the last several decades, inflation had been completely subdued. If you’re unfortunate to be old enough to remember that last bout of inflation in the 1970s, debt, specifically government debt, was supposed to be inflation's major cause. Yet, debt — public, corporate and personal — started its unprecedented growth in 80s, then really took off in the last 15 years after the 2008 financial crash. Try as they may, for over a dozen years debt growth created little inflation.

Then, back in the spring of '22, US inflation hit somewhere around 9%, I write somewhere because one of the problems with economics is the reliability of numbers. It's more than a bit ironic in this Information Age and the endless talk about data, economic numbers can be more nebulous than ever, blame the finance sector, though maybe better to start with the corporate and government sources. The only thing that ever scientific about economics was accounting, and well, accounting is more innovative than tech at this point.

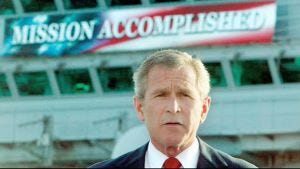

When inflation finally appeared two years ago, the pooh-bahs did what they knew how to do, the Fed raised interest rates. When the Fed started raising, rates had never been so low, at zero basically. In 18 months, they rose up above 5%, a not insignificant rise, enough it seems to tame inflation. Now, the temple priests say they've cut inflation by two-thirds, down to 3%, and Wall Street, in the immortal or was it immoral words of the very worst of American presidents, cries in unison, “Mission Accomplished!”

Nonetheless, if you ask why inflation has gone down, it's a little dumbfounding. Since the Fed raised rates, the growth in debt – public, corporate, and personal — has largely continued apace. The economy continues to grow, unemployment remains at historic lows, wages actually rose, and the stock market is now at all time highs. All things not supposed to happen with rising interest rates.

Two things did happen. First, oil, which due to the criminally stupid Russian invasion of Ukraine in February 2022, shot over a $100 a barrel, now sits below $75. If the economy didn't slow, it's difficult to say the Fed rate rise did anything to bring down the price of gasoline. Much more important, all the talk about crippling the Ruskis with economic sanctions proved less than empty. The Russians are now selling as much oil as ever. Even more ironically, oil's stayed low even with America undertaking the latest round of its three decades project blowing up the Middle East, the brutal and despicable bombing of Gaza. Though one thing has happened since the project’s inception with Desert Storm, the price of oil has climbed from $15 to $75 today, but I suppose you can just blame inflation, after all, the trillions of military dollars spent are all debt on the US ledger.

The second thing and one definitely attributable to the Fed has been a slowdown in the housing market, even a bit of a price dip. Like every US asset in the last decades, housing values are greatly based on churning — the velocity of buying and selling. 7% mortgages have not proved conducive. It reminds me a few years ago a financial player wagged that information and value mean nothing, the only thing that matters is liquidity for churning. Wall Street signals all's well, inflation is beat so off to the races. Place your bets and pay little attention to what economists say.

The torn up ticket stubs from a hundred thousand mugs

Now washed away like dead dreams in the rain

The car-parks going up and they're pulling down the pubs

It's just another bloody rainy day

In a related matter and another example why its hard to read anything about the economy is an FT article about the Bank of China, which claims the Communist party is taking greater control. Let's just say, if you ever believed the party didn't have full control of the financial system, the only one you were fooling was yourself. A decade ago, I wrote a still relevant piece about the Chinese banking system and their numbers. As bank analyst Chris Whalen said to me at that point, “Whatever you want to say about Chinese finance, it isn't a banking system.”

It does seem the Chinese economy has slowed, always inevitably destined with their borrowing the American model of industrialization. Chinese numbers can be bad as Wall Street's, so what's really happening is hard to pin down, though the FT writes, “Almost 90% of money that flowed into Chinese stocks in 2023 has left amid concern about economy.” Place your bets.

Ending on an amusing note, in this age of information the NYT is suing Microsoft and OpenAI saying they're abusing NYT's copyright – funny stuff. There is no such thing as information property, not if we’re in anyway going to figure out how to restructure society to beneficially use the information tsunami technology has unleashed. But it hits on the much more important point as to how information is valued, most essentially, what's good and what's bad information? If your training you're AI model using the NYT, how do you edit out all the bullshit the NYT continuously puts out as fact. For example from recent years the answers you’d get from a NYT trained AI:

Q – Does Saddam have weapons of mass destruction?

A – Yes

Q – Did Putin elect Trump in 2016?

A – Yes

Q – Is Joe Biden a crook?

A – No

As they say, garbage in, garbage out. Who is going to correct AI? Is there a program for that?

Sweet city of my dreams of speed and skill and schemes

Like Atlantis you just disappeared from view

And the hare upon the wire has been burnt upon your pyre

Like the black dog that once raced out from trap two

— Shane MacGowan, White City